cTrader Copy

cTrader Copy is a solution for commitment-free trading which allows investors to choose a trading strategy of successful traders and copy it automatically in real time. In turn, strategy providers earn commissions in addition to the profit from their trading.

An Investment Platform

cTrader Copy is an overhaul of the mirror trading platform, formerly known as cMirror, which functions as a flexible investment platform and a fully integrated feature of cTrader.

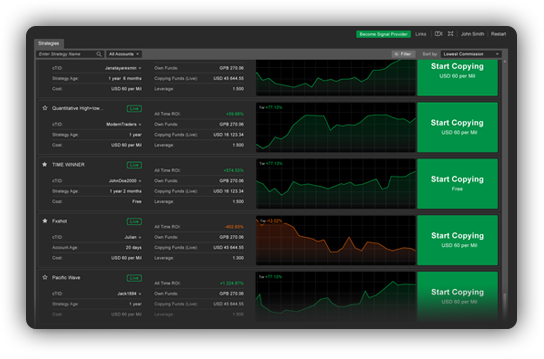

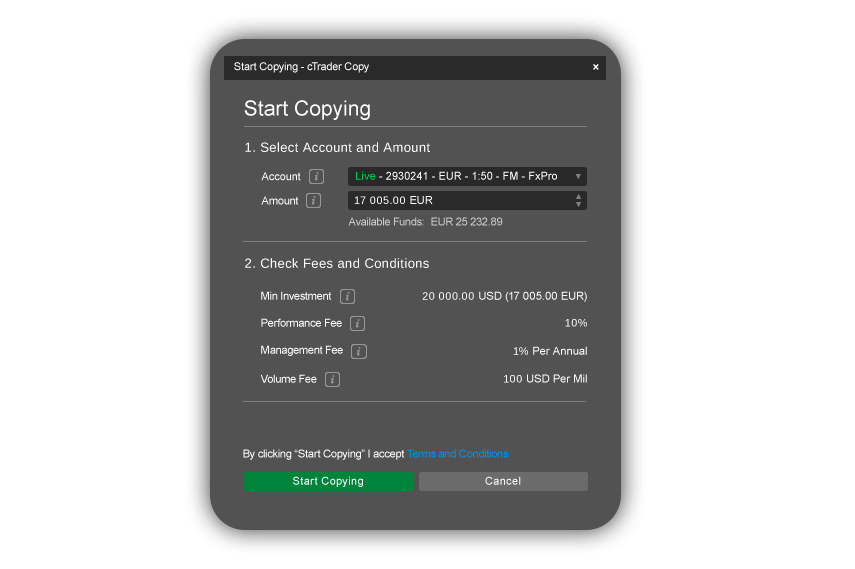

Any trader can allow copying their successful trading strategies to users for performance, management and volume fees. Investors can, in turn, discover strategies and copy them automatically. Additionally, they can use their own risk management settings.

cTrader Copy is a core component of the cTrader trading platform. It is provided to all brokers at no extra charge.

cTrader Copy is a core component of the cTrader Suite of trading platforms. It’s provided to all brokers at no extra charge.

Benefits for Brokers

Offering a copy trading service enables brokers to access a whole new segment of investors.

cTrader Copy provides you with an effective solution that will:

Increase Acquisition

Attract and convert users who want to invest rather than trade for themselves.

Extend Lifetime Value

Retain traders who were not successful with their own trading strategies.

Higher Volumes

Offer algorithmic traders a solution to increase their income by selling their automated strategies.

More Deposits

Onboard strategy providers and money managers, who will bring and actively recruit new investors.

Complete Offering

Anyone with a cTrader account can start using cTrader Copy either as an investor or a strategy provider.

Mature Marketplace

Give your investors thousands of strategies to choose from.

Benefits for Users

Anyone with a cTrader account can start using cTrader Copy, either as an investor or a Strategy Provider.

Providers

Centre stage of an open environment, offering infinite potential

Centre stage of an open environment, offering infinite potential

No induction period – start broadcasting from day one

No induction period – start broadcasting from day one

Choose exactly how much commission to charge your copiers

Choose exactly how much commission to charge your copiers

Receive commissions collected from investors each day

Receive commissions collected from investors each day

Broadcast strategies from your preferred cTrader broker

Broadcast strategies from your preferred cTrader broker

Enjoy entire strategy page, available to embed on external sites

Enjoy entire strategy page, available to embed on external sites

Investors

Copy strategies of sophisticated traders already using cTrader

Maintain control – start and stop copying a strategy at any time

Advanced risk management settings to protect your account

Full transparency, showing complete history and open positions

Rich analytics from detailed charts to help find the right strategy

User-friendly and intuitive interface

Primary Features

Advanced Analytics

Charts visually display Time Weighted ROI, Balance vs Equity, Breakdown of Traded Symbols and History of Followers. Charts can be adjusted to specific time periods. Strategy profiles include detailed tables of statistics to provide information and rich insights on performance and behaviour.

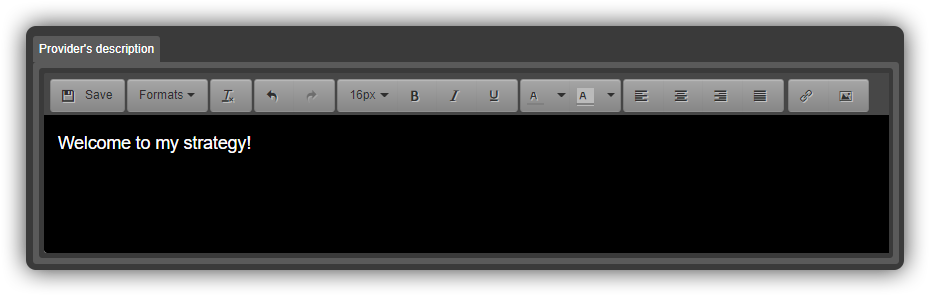

Strategy Profiles

Strategy providers can create detailed profiles to help them to promote themselves. Descriptions can be added to provide supporting information about the strategy. Each strategy has its own URL, making it easy to share with prospective investors outside of the cTader platform.

Equity to Equity Copying

Investors copy open positions as they begin to follow a strategy. The volume that will be copied is based on the equity-to-equity ratio according to the amount allocated to the strategy. An investor can set an Equity Stop Loss to stop copying altogether when equity falls below a certain level.

Favourites

Investors can bookmark strategies they are interested in to watch, monitor and come back to them later. At the same time, all strategies that are being followed are listed for easy reference and ability to modify settings at any point.

Fee Structures

Volume-based Commissions

Strategy providers can charge commissions based on the volume that their investors have traded while copying their strategy. Volume fees are added to each position and charged once for opening and once for closing positions.

Performance and Management

A popular method used by money managers which allows them to take a percentage of their clients’ ROI using a High Water Mark and a fee, according to the amount of money their investors have allocated.