FIX API for Liquidity

Spotware allows brokers to integrate with liquidity providers using FIX API – a standardised means of sending precise financial information. The use of FIX API eliminates the need to use bridge providers, reducing brokers’ operational costs and increasing interoperability.

What FIX API Means for Liquidity

The FIX API is a solution for sending messages via the FIX protocol. These messages use special tags to denote financial information (e.g. order volumes and order types), ensuring that even the most complex data is compressed into the smallest number of bytes possible. As a result, FIX API messages are concise and can be quickly interpreted by any system that is tasked to do so.

By giving brokers and liquidity providers a platform-neutral communication service, FIX API effectively ends brokers’ reliance on bridge providers. With FIX API, brokers can exchange all necessary information with liquidity providers autonomously using whatever programming language they deem suitable for serialising and deserialising FIX messages.

Key Benefits for Brokers

The ability to avoid the services of bridge providers confers several advantages for brokers.

Low operational costs

By integrating directly with liquidity providers, brokers avoid paying any additional fees to bridge providers.

Wide choice of liquidity providers

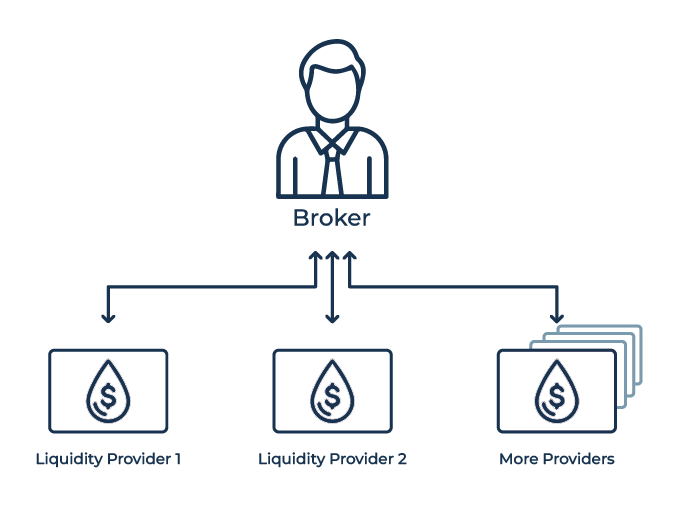

FIX messages have a standardised format, meaning that they can be successfully sent to any liquidity provider that supports the FIX protocol.

High speed and efficiency

FIX API messages are incredibly lightweight, which means that they can be sent and read in the blink of an eye (or faster). Their use allows brokers to further improve order execution speeds, incentivising trading by retail clients.

Simple automation

As all FIX API messages adhere to a pre-defined specification, programmatically sending and receiving precise financial data is simple and does not require the creation of any complex systems for communicating with liquidity providers.

Great stability

By eliminating the middleman, Spotware’s FIX API also drastically reduces the chance of human or technical error interfering with the accuracy of order execution.

Free choice of programming language

As FIX API is language-neutral, brokers can freely choose exactly how they will send FIX messages to their preferred liquidity providers.

How Spotware Helps Brokers Use FIX API

Spotware fully supports brokers who want to integrate with new liquidity providers that support FIX API. A typical process for such integration looks as follows.

1. The broker requests to integrate with a new LP.

2. Spotware communicates with the LP and asks to provide FIX API specifications and documentation.

3. Spotware creates a server adapter for communicating with the LP using FIX API.

4. The server is now able to send financial data to the LP via FIX API.

This procedure ensures that the broker gets access to their chosen LP as quickly as possible with no unnecessary workarounds.