cTrader Automate

An all-inclusive algorithmic trading solution to automate trading strategies in cTrader, seamlessly connected with manual trading and charting features. Designed with the utmost productivity and efficiency in mind.

Automated Trading

Formerly known as cAlgo, cTrader Automate is an algorithmic trading solution, natively integrated with cTrader, that works seamlessly alongside other platform functionalities. Traders can build automated trading robots and custom indicators in the popular C# language using the highly functional cTrader API from a platform which has the necessary tools to properly backtest and optimise trading strategies.

cTrader Automate.API

cTrader Automate.API is specifically designed for margin trading and uses a human-readable format to effortlessly engage users and developers. The functionality of the API is extensive and supports everything imaginable in the context of trading forex and CFDs. market data, trading history, all order types and position modification settings, as well as symbol, account, connectivity and error information, are available to incorporate as much detail as possible into automated strategies.

Millions of developers are already coding in C#, so traders can access a large

and thriving community without having to learn a new programming

language for a single platform.

Offer a trading service tailored to algo traders

and benefit from their frequent trading and high volumes.

Productivity Tools

cTrader Automate comes with a selection of features that enable users to develop robots and indicators in an efficient and effective manner.

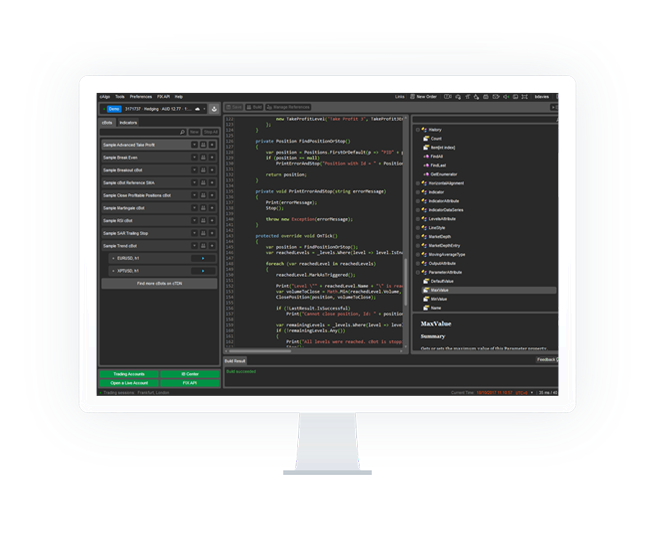

In-built Code Editor

Code for robots and indicators can be written using Visual Studio or the built-in code editor. The code editor is designed to make coding as straightforward and hassle-free as possible, including useful functionalities such as search, auto-formatting and code completion.

Automate.API

Automate.API is a powerful API that gives you access to all the necessary functionalities for developing a robot or an indicator, including market data, prebuilt indicators and trading functions. By utilising this API, and its robust and fully tested classes and functions, algo developers save a considerable amount of precious time.

Plug and Play Automated Trading

cTrader’s “plug and play” functionality allows you to load a robot or indicator (or download one from other users in the community) and click “play” to instantly begin trading without engaging in complicated installation procedures. With “plug and play” you can install and run cBots in seconds.

Features

A wide range of features is available to support any trader or developer in the creation of their automated trading strategies and custom indicators.

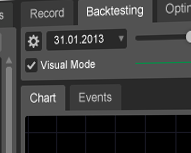

Visual Backtesting

With cTrader, you can access a visual backtesting tool that allows you to test cBots on historical data and monitor the trading process on a chart. You can also adjust the speed of the process.

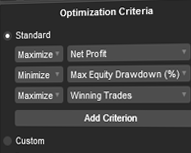

Optimisation

An advanced optimisation functionality lets traders find the optimal set of parameters for their cBot. Optimisation runs multiple backtest procedures and compares their performance.

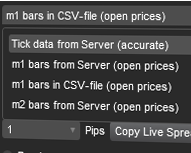

Historical Data

cTrader gives access to historical data of dozens of symbols. Robots can be backtested against accurate historical data for a large number of timeframes, including raw tick data.

Trade Statistics

Trade statistics for backtesting results: Net Profit, Max Balance Drawdown, Max Equity Drawdown, Winning Trades and other useful information related to your backtest.

Backtesting History

The entire detailed history of your backtesting. Trace each deal and view useful information: entry and close time and price, net and gross profit, volume and direction of each deal.

Deal Map

Visualisation of executed deals on the chart. You can improve strategies by identifying opening and closing moments of deals and correlating them with underlying price movements.

Community

Benefit from a thriving community of traders, financial experts and consultants, as well as a variety of user-submitted robots and custom indicators, fully dedicated to supporting your algorithmic trading needs.

Forum

The cTrader forum gives you an opportunity to ask questions, discuss and share ideas, as well as collaborate with other members of the community. Improve your knowledge and expedite your development by getting assistance and interacting with experienced community members.

Library

An extended and constantly growing library of robots and custom indicators is available to you at any time. Stop reinventing the wheel and make use of the work done and shared by fellow traders. You can also share your own results and display your automated trading skills.

Consultants

A growing list of consultants ensures you can always seek help with your project. Professionals from the financial industry, experienced in Automate.API and algorithmic trading, are at your disposal to help complete or refine your project.